China's Race to the Stars: Ambitious Satellite Programs Face Critical Challenges

By International Tech Reporter

May 21, 2025

In the race to dominate the skies, China has embarked on two of the most ambitious satellite communication projects in history. But new analysis reveals a stark reality gap between Beijing's astronomical ambitions and its current progress.

Twin Constellations with Grand Ambitions

China is simultaneously developing two massive satellite constellations – Guowang ("National Network") and Qianfan ("Thousand Sails") – each planning to deploy more than 13,000 satellites to provide global internet coverage. These projects represent Beijing's strategic push to challenge U.S. dominance in space-based internet services, particularly SpaceX's Starlink.

"These aren't just infrastructure projects – they're strategic assets with significant geopolitical implications," says Dr. Wei Chen, a space policy analyst at the East Asia Institute. "Beijing views space-based internet as critical national infrastructure, similar to how they approached 5G development."

The Numbers Tell a Sobering Story

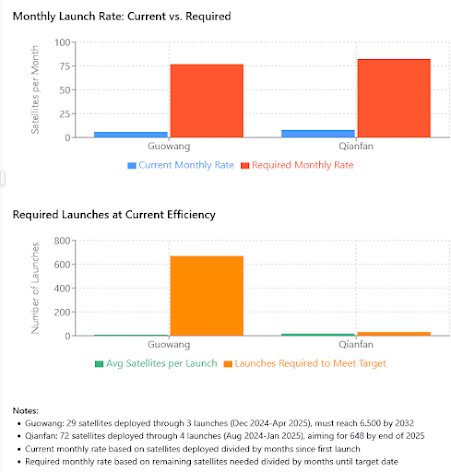

Since Guowang's first launch in December 2024, China has placed only 29 satellites into orbit across three missions, while Qianfan – which began deployment in August 2024 – has launched 72 satellites over four missions.

The pace falls dramatically short of what's needed. To meet its ITU-mandated target of 6,500 satellites by 2032, Guowang would need to increase its monthly deployment rate from the current 5.8 satellites per month to approximately 86 – a fifteen-fold increase. Similarly, Qianfan needs to accelerate from 8 to 82 satellites monthly to reach its self-imposed target of 648 satellites by the end of 2025.

"At the current pace, Qianfan would need nearly 32 more launches within seven months to meet its 2025 target," notes aerospace engineer Dr. Sarah Williams. "That's more satellite launches than China conducted in total during all of 2023."

A Tale of Two Programs

While both projects share similar ambitions, they differ significantly in structure and transparency.

Guowang is managed by China Satellite Network Group Co. (China Satnet), a secretive state-owned enterprise established in 2021. Little information about its operations has been made public, and the company lacks even a website – unusual for a project of such scale.

In contrast, Qianfan operates with greater visibility. Run by Shanghai Spacecom Satellite Technology (SSST), it secured nearly $1 billion in funding in early 2024 and benefits from substantial backing by the Shanghai municipal government. The company has released technical details about its flat-panel satellites, which orbit at around 800 kilometers altitude.

Launch Capacity: The Critical Bottleneck

Industry experts point to launch capacity as the primary constraint on China's satellite ambitions.

"China conducted 62 orbital launches in 2024, just shy of their record 67 launches in 2023," explains Jonathan Dao, a space industry analyst. "But deploying these constellations at the planned scale would require a dramatic increase in launch frequency – potentially several hundred launches per year."

China is racing to address this limitation with new infrastructure, including:

- A new commercial spaceport in Hainan that became operational in 2024

- A massive rocket assembly plant under construction in Hainan

- Development of the Long March 12, China's first four-meter-class launcher designed specifically for constellation deployment

Several Chinese commercial launch companies are also developing reusable rockets, with Landspace's Zhuque-3 – comparable to SpaceX's Falcon 9 – slated for its first launch later this year.

Technical Challenges Beyond Launch Rates

Both constellations face additional technical hurdles. The Long March 6A rocket's upper stage fragmented after Qianfan's first launch in August 2024, creating over 300 pieces of trackable debris – raising concerns about China's ability to safely deploy thousands of satellites.

Astronomers have also raised alarms about Qianfan satellites' brightness, which exceeds recommended limits and threatens ground-based astronomical observations. "The brightness levels we're measuring from these satellites suggest they haven't implemented the same mitigations as newer Starlink satellites," notes Dr. Elena Rodriguez, an astronomer at the International Observatory Consortium.

The Starlink Gap Continues to Widen

As China works to accelerate its deployment, SpaceX continues to extend its lead. Starlink now operates over 6,800 satellites, with SpaceX launching approximately 3.5 satellites daily since the constellation's inception in 2019.

"The gap isn't just in numbers," says telecommunications analyst Wei Zhang. "SpaceX's iterative design approach means they're now on their fourth generation of satellites, while China is still deploying first-generation models."

Strategic Implications

Despite the challenges, experts caution against underestimating China's determination. "These programs represent core national priorities for Beijing," says former defense intelligence analyst Martin Kuo. "Even if timelines slip, China has demonstrated remarkable persistence in strategic technology initiatives."

The constellations serve multiple strategic functions beyond commercial applications, potentially enhancing China's military communications capabilities and providing technology independence from foreign satellite systems.

The Path Forward

Chinese officials remain publicly confident about meeting deployment targets. State media recently highlighted the success of both constellations' initial launches without addressing the pace concerns.

Industry insiders suggest China may modify its approach in response to the reality gap. "We may see revised timelines, or a shift toward deploying smaller-scale initial service capabilities focused on key regions," suggests telecommunications consultant Dr. Lisa Chen.

What's certain is that China's space ambitions remain undimmed, even as the technical reality proves more challenging than expected. The coming year will be critical in determining whether these massive satellite constellations represent China's next technological leap forward – or a case of celestial overreach.

This article was based on an analysis of launch data, technical specifications, and deployment timelines for China's Guowang and Qianfan satellite constellations as of May 2025.

Engineering Report: China's LEO Satellite Communication Projects - Guowang and Qianfan

Executive Summary

This report provides a technical analysis of China's two major Low Earth Orbit (LEO) satellite communication projects: Guowang ("National Network") and Qianfan ("Thousand Sails"). Both projects represent China's strategic initiative to develop robust satellite internet capabilities comparable to SpaceX's Starlink. As of May 2025, both constellations are in the early deployment phase with ambitious launch schedules planned through 2030-2032.

1. Introduction

China is developing multiple satellite communication constellations to establish a global LEO-based internet infrastructure. This report focuses on the two primary government-backed initiatives:

- Guowang ("National Network") - Operated by China Satellite Network Group Co. (China Satnet)

- Qianfan ("Thousand Sails") - Operated by Shanghai Spacecom Satellite Technology (SSST)

Both projects aim to deploy thousands of satellites to provide global broadband coverage, enhance China's technological independence, and establish a competitive position in the global satellite internet market.

2. Guowang Project

2.1 Overview and Organization

Guowang was officially announced in 2020 when China filed with the International Telecommunication Union (ITU) for spectrum allocation for a constellation of nearly 13,000 satellites. The project is managed by China Satellite Network Group Co. (China Satnet), established in April 2021 as a state-owned enterprise.

The China Academy of Space Technology (CAST), a subsidiary of the China Aerospace Science and Technology Corporation (CASC), is responsible for developing the satellites. Both entities are owned by the Chinese government, underlining the strategic importance of the project.

2.2 Technical Specifications

Based on available information, Guowang satellites are being deployed at altitudes around 1,100 km. The project involves two satellite platforms:

- A larger platform deployed via Long March 5B rockets

- A smaller platform launched on Long March 8A rockets

Specific technical details about the satellites' capabilities, communication technologies, and bandwidth have not been widely disclosed.

2.3 Launch Status and Progress

As of May 2025, the Guowang constellation has conducted the following launches:

- First launch: December 16, 2024 - 10 satellites deployed via Long March 5B rocket from Wenchang Space Launch Center

- Second launch: February 2025 - 9 satellites deployed via Long March 8A rocket

- Third launch: April 28, 2025 - 10 satellites (estimated) deployed via Long March 5B rocket with Yuanzheng-2 upper stage

Current deployment: Approximately 29 Guowang satellites in orbit

2.4 Launch Strategy and Timeline

According to ITU regulations, China Satnet must deploy half of the planned 13,000 satellites (approximately 6,500) by 2032. This requirement necessitates a significant acceleration in China's launch cadence over the coming years.

The project is utilizing multiple rocket types:

- Long March 5B (heavy-lift) with Yuanzheng-2 upper stage

- Long March 8A (medium-lift)

The use of the Yuanzheng-2 upper stage in the April 2025 launch marks an improvement in deployment strategy, allowing the first stage to remain suborbital and avoid uncontrolled reentries that plagued earlier Long March 5B missions.

3. Qianfan Project

3.1 Overview and Organization

Qianfan ("Thousand Sails"), also known as G60 Starlink, is operated by Shanghai Spacecom Satellite Technology (SSST), a company backed by the Shanghai municipal government. The project was established as part of Shanghai's regional technology innovation initiatives.

In February 2024, SSST secured significant funding of approximately $943 million for constellation development.

3.2 Technical Specifications

Qianfan satellites utilize a flat-panel design similar to SpaceX's Starlink satellites, allowing for efficient stacking during launch. Each satellite is estimated to weigh around 300 kg (660 pounds).

The satellites are being deployed in polar orbits inclined 89° to Earth's equator at altitudes near 800 kilometers, positioning them above SpaceX's Starlink (at approximately 550 km) and below Eutelsat OneWeb's constellation.

The constellation is designed to operate in multiple frequency bands including Ku, Q, and V bands.

3.3 Launch Status and Progress

As of May 2025, the Qianfan constellation has conducted the following launches:

- First launch: August 6, 2024 - 18 satellites via Long March 6A from Taiyuan Launch Center

- Second launch: October 15, 2024 - 18 satellites via Long March 6A

- Third launch: December 5, 2024 - 18 satellites via Long March 6A

- Fourth launch: January 23, 2025 - 18 satellites via Long March 6 from Taiyuan Launch Center

Current deployment: 72 Qianfan satellites in orbit

3.4 Launch Strategy and Timeline

SSST has outlined a phased deployment strategy:

- 108 satellites planned for orbit by end of 2024 (partially achieved)

- 648 satellites targeted by end of 2025 (Phase 1-A)

- 1,296 satellites by end of 2027 (completion of Phase 1)

- Ultimate constellation size of approximately 14,000-15,000 satellites by 2030

The project is primarily using Long March 6A rockets but has also begun utilizing the Long March 6 and is exploring using Long March 8 for larger payload capacity.

4. Manufacturing and Launch Infrastructure

4.1 Manufacturing Capacity

For Qianfan, SSST has established satellite manufacturing facilities with the following reported capacities:

- Current production capacity estimated at 300 satellites per year

- Subsidiary Genesat received $137 million in funding in December 2024 to expand manufacturing capabilities

For Guowang, specific manufacturing details are less transparent, but CAST has developed dedicated production lines for both large and small satellite platforms.

4.2 Launch Infrastructure Development

To support the ambitious launch schedules for both constellations, China is developing:

-

New commercial spaceport in Hainan - The Hainan International Commercial Aerospace Launch Center became operational in 2024, marking China's first commercial launch site

-

Rocket assembly plant in Hainan - A new facility to increase rocket production rate

-

New and upgraded launch vehicles:

- Long March 5B - Heavy-lift rocket for larger satellite batches

- Long March 8A - Upgraded version following December 2020 debut

- Long March 12 - China's first four-meter-class launcher, specifically designed for constellation deployment

- Private companies developing reusable rockets (expected 2025+)

5. Challenges and Technical Issues

Several technical and operational challenges have been observed:

-

Debris issues - The Long March 6A upper stage fragmented after the first Qianfan launch in August 2024, creating over 300 pieces of trackable debris in LEO

-

Satellite brightness concerns - Initial observations indicate Qianfan satellites exceed brightness limits recommended by astronomical authorities, potentially impacting astronomical observations

-

Launch rate limitations - China's current launch capabilities (67 launches in 2023, 62 in 2024) remain significantly below what's needed for full constellation deployment on the announced timeline

-

Reusable rocket technology - China is still developing reusable launch capabilities comparable to SpaceX's Falcon 9, which is critical for economical deployment of thousands of satellites

6. Strategic Context and International Positioning

Both Guowang and Qianfan represent China's strategic response to SpaceX's Starlink, which currently dominates the LEO broadband market with over 6,800 operational satellites as of December 2024.

These constellations serve multiple strategic objectives:

- Providing global broadband internet coverage

- Ensuring domestic technological independence from foreign providers

- Establishing China as a leader in space-based infrastructure

- Potentially supporting military and security applications

China faces significant hurdles in catching up to SpaceX, which has launched approximately 3.5 satellites per day since Starlink began deployment in May 2019. Current Chinese launch and manufacturing capabilities remain substantially behind this pace.

7. Comparative Analysis with Other Constellations

| Constellation | Operator | Current Satellites (May 2025) | Planned Total | Deployment Timeline |

|---|---|---|---|---|

| Guowang | China Satnet | ~29 | 13,000 | 6,500 by 2032 |

| Qianfan | SSST | 72 | 14,000-15,000 | 648 by end of 2025, 1,296 by 2027 |

| Starlink | SpaceX | >6,800 | >42,000 (approved) | Ongoing (~3.5 satellites/day) |

| OneWeb | Eutelsat | >630 | ~650 | Near completion |

8. Future Outlook

Both Chinese constellations face substantial challenges in meeting their ambitious deployment schedules. Key factors that will determine their success include:

- Development of reusable rocket technology to reduce launch costs

- Scaling of satellite manufacturing capacity

- Resolution of technical issues with current satellite designs

- International regulatory approvals for global service provision

Given current capabilities and progress, it appears unlikely that either constellation will meet its most ambitious timeline targets without significant acceleration in both manufacturing and launch capabilities.

9. Conclusion

China's Guowang and Qianfan projects represent significant strategic investments in LEO satellite communications infrastructure. While both constellations are in early deployment phases as of May 2025, they demonstrate China's determination to establish a competitive position in this critical technology domain.

The observed launch rate through early 2025 suggests that China is making steady progress but remains significantly behind the pace needed to fully deploy these constellations on the announced timelines. The next 12-24 months will be critical in determining whether China can overcome manufacturing and launch limitations to accelerate deployment.

10. References

-

Space.com. (2024, December 18). "China launches 1st set of spacecraft for planned 13,000-satellite broadband constellation." https://www.space.com/space-exploration/launches-spacecraft/china-launches-1st-set-of-spacecraft-for-planned-13-000-satellite-broadband-constellation-photo

-

SpaceNews. (2025, April). "China launches third batch of Guowang megaconstellation satellites." https://spacenews.com/china-launches-third-batch-of-guowang-megaconstellation-satellites/

-

Space.com. (2024, August 7). "China launches 1st batch of satellites for planned 14,000-strong megaconstellation." https://www.space.com/china-first-launch-internet-satellite-megaconstellation

-

Wikipedia. (2025, May). "Qianfan." https://en.wikipedia.org/wiki/Qianfan

-

Sky & Telescope. (2024, September 27). "Observers' Report: First Views of the Chinese 'Thousand Sails' Satellites." https://skyandtelescope.org/astronomy-news/observers-report-first-views-of-the-chinese-thousand-sails-satellites/

-

Telecomstechnews. (2024, December 17). "China launches first satellites for GuoWang constellation." https://www.telecomstechnews.com/news/china-launches-first-satellites-guowang-constellation/

-

Resonant News. (2025, January 25). "Two Launches by China; Classified TJS-14 & 4th batch of 1000 Sails constellation and An Accident." https://resonantnews.com/2025/01/25/two-launches-by-china-classified-tjs-14-4th-batch-of-1000-sails-constellation-and-an-accident/

-

CircleID. (2024, June 5). "Two New Chinese Internet Service Constellations and Their Market." https://circleid.com/posts/20240605-two-new-chinese-internet-service-constellations-and-their-market

-

Extremarationews. (2024, December 19). "Satellite Internet: China has successfully launched the Guowang Group's first spacecraft into orbit." https://www.extremarationews.com/post/satellite-internet-china-has-successfully-launched-the-guowang-group-s-first-spacecraft-into-orbit

-

CNN. (2024, August 9). "China launches satellites to rival SpaceX's Starlink in boost for its space ambitions." https://www.cnn.com/2024/08/09/china/china-satellite-qianfan-g60-starlink-intl-hnk/index.html

-

IEEE Spectrum. (2024, August 27). "China's Qianfan Megaconstellation Aims at SpaceX's Starlink." https://spectrum.ieee.org/satellite-internet

-

The Express Tribune. (2024, December 13). "China set to target megaconstellations with upgraded Long March rockets." https://tribune.com.pk/story/2515780/1

-

Via Satellite. (2025, February 6). "Measat Signs MoU With China's Spacesail LEO Constellation." https://www.satellitetoday.com/connectivity/2025/02/06/measat-signs-mou-with-chinas-spacesail-leo-constellation/

-

Modern Diplomacy. (2025, January 22). "China's Strategic Ascent in Space: New Dynamics in 2025." https://moderndiplomacy.eu/2025/01/22/chinas-strategic-ascent-in-space-new-dynamics-in-2025/

No comments:

Post a Comment