|

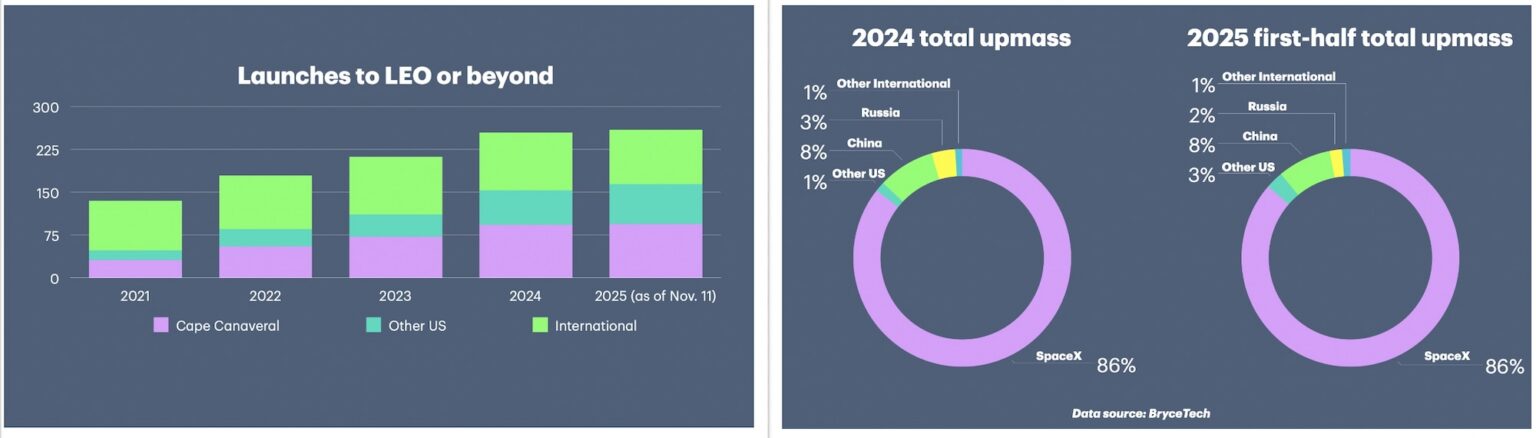

| Launch rates are on a clear upward trend, while SpaceX has launched 86 percent of the world’s total payload mass to orbit since the beginning of 2024. Credit: Stephen Clark/Ars Technica/BryceTech |

With another record broken, the world’s busiest spaceport keeps getting busier - Ars Technica

A dramatic surge in launch activity marks a fundamental shift in humanity's relationship with space

On a quiet Monday night at Cape Canaveral, a Falcon 9 rocket pierced the Florida darkness, carrying 29 Starlink satellites toward orbit. For most observers, the launch barely registered—just another routine addition to an increasingly crowded orbital highway. Yet this seemingly mundane event marked a historic milestone: the 94th orbital launch from Florida's Space Coast in 2025, shattering previous records and underscoring a profound transformation in space access that extends far beyond American shores.

As anyone watching space can tell you, the world is experiencing an unprecedented surge in rocket launches. As of mid-November 2025, humanity has conducted 259 missions to reach orbit this year, placing the planet on track for approximately 300 orbital launches by year's end—more than double the 135 launches recorded in 2021. This acceleration represents not merely a quantitative increase but a qualitative shift in how humanity accesses space, driven by advances in reusable rocket technology and the emergence of commercial satellite megaconstellations across multiple nations and companies.

The Reusability Revolution

The dramatic uptick in launch frequency follows decades of stagnation. Throughout the 2000s, orbital launch numbers declined steadily, bottoming out at just 52 missions in 2005—the lowest figure since 1961, during spaceflight's infancy. Florida's Space Coast witnessed merely seven launches that year. The resurgence began approximately five years ago as SpaceX mastered reusable rocketry, fundamentally altering the economics of space access.

The Falcon 9 rocket exemplifies this transformation. With a failure rate below 1 percent, it has become the most reliable orbital-class launch vehicle in history. This reliability, combined with reusability, has enabled SpaceX to achieve unprecedented launch cadences. The company has conducted 144 Falcon 9 launches through mid-November 2025 and is projected to reach between 165 and 170 missions for the year—compared to a combined 134 Falcon 9 and Falcon Heavy missions in 2024.

However, raw launch numbers tell only part of the story. According to analyses by BryceTech, an engineering and space industry consulting firm, SpaceX has launched 86 percent of the world's total payload mass during the 18-month period from January 2024 through June 2025—approximately 2.98 million kilograms of the global total of 3.46 million kilograms. This dominance reflects not just launch frequency but also efficient utilization of the Falcon 9's payload capacity, with up to 29 Starlink satellites packed aboard each mission.

Global Launch Activity: A Multinational Endeavor

While SpaceX dominates payload mass, the surge in launch activity reflects a truly global phenomenon involving space agencies and commercial companies across continents.

Table: 2025 Launch Activity to Low Earth Orbit by Launch Vehicle

Data Period: January - November 2025

| Launch Vehicle | Country/Region | Operator | Number of Launches | Estimated Total Mass to LEO (kg) | Reusable | Status |

|---|---|---|---|---|---|---|

| Falcon 9 | United States | SpaceX | 144+ | ~2,500,000+ | Yes (1st stage) | Operational |

| Long March Family | China | CNSA/CASC | 40-50* | ~180,000-250,000 | No | Operational |

| Electron | United States/New Zealand | Rocket Lab | 15-17 | ~2,000-2,500 | Partial (testing) | Operational |

| Soyuz 2 | Russia | Roscosmos | 10-15* | ~80,000-120,000 | No | Operational |

| H3 | Japan | JAXA/MHI | 6-7 | ~30,000-35,000 | No | Operational |

| Atlas V | United States | ULA | 4-5 | ~35,000-45,000 | No | Final flights |

| Vulcan Centaur | United States | ULA | 3-4 | ~30,000-40,000 | Planned (1st stage) | Operational |

| Ariane 6 | Europe | Arianespace/ESA | 4-5 | ~40,000-50,000 | No | Operational |

| Vega-C | Europe | Arianespace/Avio | 3-4 | ~3,000-4,000 | No | Operational |

| Falcon Heavy | United States | SpaceX | 2-3 | ~50,000-75,000 | Yes (boosters) | Operational |

| New Glenn | United States | Blue Origin | 1 | ~15,000-20,000 | Planned (1st stage) | Test phase |

| Jielong-3 | China | CASC/Chinarocket | 4-5 | ~6,000-8,000 | No | Operational |

| GSLV/PSLV | India | ISRO | 4-6* | ~20,000-30,000 | No | Operational |

| Antares | United States | Northrop Grumman | 2-3 | ~14,000-21,000 | No | Operational |

| Angara | Russia | Roscosmos | 1-2* | ~15,000-30,000 | No | Limited operations |

| Other Vehicles | Various | Various | 10-15 | ~15,000-25,000 | Varies | Various |

Notes:

Asterisk () indicates estimated figures based on typical annual activity adjusted for 2025 data availability*

Key Findings:

-

SpaceX Dominance: Falcon 9 accounts for approximately 55-60% of all orbital launches globally and roughly 86% of total payload mass to orbit (per BryceTech analysis covering January 2024-June 2025).

-

Mass vs. Launch Count: While SpaceX conducts more than half of global launches, its dominance in total mass is even more pronounced due to:

- High individual payload capacity (up to 22,800 kg to LEO)

- Efficient payload packing (29 Starlink satellites per launch)

- High flight rate enabling consistent mass delivery

-

Reusability Gap: Only SpaceX has demonstrated operational first-stage reusability at scale. Blue Origin and Rocket Lab are developing reusable systems, but as of November 2025, SpaceX remains the sole provider achieving routine recovery and reuse.

-

Regional Distribution:

- United States: ~165-175 launches (~2,600,000-2,700,000 kg)

- China: ~50-60 launches (~200,000-280,000 kg)

- Russia: ~15-20 launches (~100,000-150,000 kg)

- Europe: ~7-10 launches (~45,000-55,000 kg)

- Japan: ~6-7 launches (~30,000-35,000 kg)

- India: ~4-6 launches (~20,000-30,000 kg)

- Other: ~10-15 launches (~15,000-25,000 kg)

-

Global Total: Approximately 259 orbital launches through mid-November 2025, projected to reach ~300 by year-end, with total mass to orbit exceeding 3 million kilograms.

Data Sources:

- BryceTech global launch and payload mass analysis (January 2024-June 2025)

- Public launch manifests from SpaceX, Blue Origin, Rocket Lab, ULA, Arianespace, JAXA

- Wikipedia's 2025 in Spaceflight compilation

- NASASpaceflight.com and Spaceflight Now launch tracking

- Industry reporting from Ars Technica and SpaceNews

Methodology Note: LEO mass calculations are estimates based on known payload configurations and rocket capabilities. Actual delivered mass may vary based on specific orbital parameters, payload densities, and mission profiles. Some launches deliver payloads beyond LEO (GTO, interplanetary trajectories) and are not included in LEO mass totals. Chinese launch data is estimated based on historical patterns and confirmed public launches.

NASA's Expanding Role

NASA continues to play a critical role in launch activity through its Commercial Lunar Payload Services (CLPS) program and partnerships with commercial providers. In 2025, NASA supported multiple successful lunar missions, including Firefly Aerospace's Blue Ghost Mission 1, which landed at Mare Crisium on March 2 and transmitted over 110 gigabytes of scientific data—far surpassing previous CLPS mission yields. NASA also launched the joint NASA-ISRO Synthetic Aperture Radar (NISAR) satellite on July 30, 2025, marking the first dual-band radar imaging satellite for remote sensing. The agency's IMAP (Interstellar Mapping and Acceleration Probe) launched aboard a Falcon 9 on September 24, while the Sentinel-6B ocean-monitoring satellite is scheduled for a November 17 launch from Vandenberg Space Force Base through NASA's Launch Services Program.

Europe's Launch Renaissance

Europe has made significant strides in reestablishing independent access to space following the disruption caused by Russia's withdrawal of Soyuz launch services from French Guiana in 2022. The European Space Agency's Ariane 6 rocket, developed jointly with the French space agency CNES and manufactured by ArianeGroup, achieved its first commercial launch on March 6, 2025, successfully deploying the CSO-3 French military reconnaissance satellite. Following a maiden test flight in July 2024, Ariane 6 has completed multiple missions in 2025, with ESA Director of Space Transportation Toni Tolker-Nielsen emphasizing plans to increase the annual launch rate to 12 missions.

The Ariane 6 rocket represents Europe's commitment to cost-competitive launch services, with prices projected around $50 million per flight. The rocket uses a modular design with two configurations: Ariane 62 with two solid rocket boosters, and Ariane 64 with four boosters. For Amazon's Project Kuiper megaconstellation, 16 of 18 planned launches will use upgraded P160C boosters with enhanced capacity.

Europe's smaller Vega-C rocket, operated by Arianespace and manufactured by Avio, returned to flight in December 2024 after a 2022 failure and has conducted multiple successful missions in 2025. The Vega-C launched ESA's Biomass forest-monitoring satellite on April 29, 2025, marking the rocket's fourth flight overall. Arianespace is transitioning Vega operations to Avio, with Arianespace remaining as launch service provider through the fourth quarter of 2025 before Avio assumes full control.

Japan's H3 Rocket Comes of Age

Japan's space program achieved a significant milestone with the successful operational deployment of the H3 rocket, jointly developed by JAXA and Mitsubishi Heavy Industries. After a failed debut in March 2023, the H3 achieved six consecutive successful flights in 2024-2025, culminating in the October 26, 2025 launch of the HTV-X1 cargo spacecraft to the International Space Station—the first mission for Japan's next-generation cargo vehicle.

The HTV-X1 launch marked the debut of the H3's most powerful configuration, featuring four solid rocket boosters and a larger fairing to accommodate bulkier payloads. The H3 is designed to halve launch costs and preparation time compared to its H-IIA predecessor, with launch prices estimated at approximately $37-50 million. JAXA President Hiroshi Yamakawa called the HTV-X1 mission "a major step forward" demonstrating Japan's autonomous space capability. The HTV-X is designed not only for ISS resupply but also for potential lunar missions, including cargo delivery to NASA's planned Gateway lunar space station.

Australia Emerges as Launch and Return Hub

Australia is positioning itself as a major player in the global launch industry, capitalizing on its geographic advantages and regulatory framework. Southern Launch operates two spaceports in South Australia: the Koonibba Test Range—the largest commercial rocket testing facility in the Southern Hemisphere at 41,000 square kilometers—and the Whalers Way Orbital Launch Complex.

In a world-first achievement, Varda Space Industries successfully returned its Winnebago-2 (W-2) capsule to the Koonibba Test Range on February 28, 2025, marking the first commercial return to a commercial spaceport anywhere in the world. This was followed by the W-3 capsule landing in May 2025. In September 2025, Southern Launch and Varda signed an agreement for up to 20 additional spacecraft returns through 2028, with Varda planning monthly missions as it scales up microgravity manufacturing operations.

The Australia-US Technology Safeguards Agreement (TSA), finalized in 2024, enables U.S. companies including SpaceX to operate in Australian territory and waters. The Australian Space Agency estimates the agreement could facilitate up to 100 space launches over the next decade, contributing approximately AUD$1 billion to the Australian economy. SpaceX is reportedly in discussions about bringing down Starship rocket stages off Australia's northwest coast.

Australian launch provider Gilmour Space Technologies attempted the country's first orbital launch on July 30, 2025, with its Eris rocket achieving 14 seconds of flight—deemed a success for the valuable data gained. Southern Launch has also conducted multiple successful suborbital missions, including the May 2024 launch of Germany's HyImpulse SR75 rocket, marking Australia's first high-powered rocket launch.

Blue Origin Enters the Heavy-Lift Market

Blue Origin's New Glenn rocket made its orbital debut on January 16, 2025, successfully reaching orbit on its first attempt and deploying the Blue Ring Pathfinder payload to medium Earth orbit. The 98-meter-tall heavy-lift rocket, powered by seven BE-4 engines, represents Blue Origin's entry into the commercial orbital launch market after years of development. While the inaugural flight successfully delivered its payload, the first-stage booster failed to land on the company's recovery ship Jacklyn in the Atlantic Ocean.

Blue Origin's second New Glenn launch, carrying NASA's ESCAPADE Mars mission, has faced multiple delays due to weather and solar activity, with the latest attempt scheduled for November 13, 2025. The company has contracts with NASA, Amazon's Project Kuiper, AST SpaceMobile, and telecommunications providers. Blue Origin is working toward National Security Space Launch certification and aims to increase its launch cadence in 2026, with CEO Dave Limp stating the company has seven to eight upper stages and two boosters in production.

Rocket Lab: Small Satellite Launch Leader

New Zealand-based Rocket Lab (a U.S. company with operations in New Zealand and Virginia) has established itself as the second-most prolific private launch provider after SpaceX. Through November 2025, Rocket Lab has conducted 74 Electron launches from its Launch Complex 1 at Māhia Peninsula, New Zealand, and Launch Complex 2 at Wallops Island, Virginia. The company maintains 100 percent mission success for 2025 launches and is on track for approximately 15-20 Electron missions for the year.

Rocket Lab is developing the medium-lift Neutron rocket, designed to compete in the increasingly crowded launch market. Originally targeting a 2025 debut, Neutron's first flight has been delayed to 2026 as the company completes additional testing and qualification work. CEO Sir Peter Beck emphasized during November 2025 earnings that the company will not rush to launch, stating: "You won't see us minimizing some qualifier about us just clearing the pad and claiming success." The 43-meter-tall Neutron will launch from Launch Complex 3 at Virginia's Mid-Atlantic Regional Spaceport, with the first commercial customer already secured for two missions in 2026.

The Megaconstellation Driver

Much of the current launch surge serves a singular purpose: deploying satellite megaconstellations for global broadband Internet service. SpaceX's Starlink network leads this charge, with more than half of 2025's launches dedicated to expanding this orbital infrastructure. Each Starlink satellite, while relatively modest in size individually, collectively represents a massive orbital presence when multiplied across thousands of spacecraft.

This pattern is poised to intensify. Amazon's Project Kuiper constellation awaits large-scale deployment, while China's Guowang and Qianfan megaconstellations—comprising thousands of satellites each—will require substantial increases in Chinese launch activity. China has been steadily increasing its launch cadence, with the Long March 11 rocket conducting sea-based launches and various other Long March variants supporting constellation deployment. The U.S. military's proposed Golden Dome missile defense shield will add further demand for orbital delivery capacity.

The Starship Factor

The next phase of this evolution centers on SpaceX's Starship megarocket, designed for full and rapid reusability with the eventual goal of multiple daily flights. When Starship begins operational missions to low-Earth orbit—potentially in 2026, following delays in 2025—it will carry SpaceX's next-generation Starlink satellites, launching 60 at a time compared to the 29 aboard current Falcon 9 missions.

The capacity differential is staggering: a fully loaded Starship could deliver 60 times more Starlink capacity than a Falcon 9 mission. Just two Starship flights could match an entire year's worth of Starlink deployment at current Falcon 9 rates. This efficiency suggests that peak Falcon 9 launch rates may occur in 2025 and 2026, according to Stephanie Bednarek, SpaceX's vice president of commercial sales, before transitioning to the larger vehicle.

Yet Starship's timeline for matching Falcon 9's proven tempo remains uncertain. The rocket has conducted multiple test flights in 2025, all following suborbital trajectories. A critical in-space propellant transfer demonstration using two docked Starships—essential for lunar missions—was postponed from 2025 to 2026 after setbacks in the Starship program.

A Constrained Market

Paradoxically, despite record launch rates, the satellite industry faces a capacity shortage. "The industry is likely to remain supply-constrained through the balance of the decade," notes Caleb Henry, director of research at Quilty Space, an industry analysis firm. This constraint could impede deployment of numerous planned constellations and limit growth in emerging applications such as satellite-to-smartphone connectivity, space-based data processing, and military satellite networks.

New entrants are racing to capture market share. United Launch Alliance continues operations with its Vulcan rocket and the final flights of the venerable Atlas V, which launched the ViaSat-3 F2 communications satellite in November 2025. Other emerging competitors include Stoke Space's Nova, Relativity Space's Terran R, and the collaborative Firefly Aerospace-Northrop Grumman Eclipse—all vying for portions of the launch market.

"Whether or not the market can support six medium to heavy lift launch providers from the US alone—plus Starship—is an open question," Henry observes, "but for the remainder of the decade launch demand is likely to remain high, presenting an opportunity for one or more new players to establish themselves in the pecking order."

The Routinization Paradox

The normalization of rocket launches presents both opportunity and risk. Aerospace engineers have long maintained that spaceflight must never become truly "routine," fearing that complacency breeds failure. The catastrophic losses of space shuttles Challenger and Columbia underscore this warning's validity.

Yet launches increasingly resemble routine operations. On the night of the 94th Florida launch in 2025, observers numbered in the single digits—a stark contrast to the crowds that once gathered for any rocket departure. Orlando International Airport, located nearby, processed an equivalent number of aircraft departures in just three hours that same evening.

This comparison, while superficially apt, masks fundamental differences. Rockets operate under extreme conditions that aircraft never encounter: engines generating enormous thrust at extreme pressures, unable to draw oxygen from the atmosphere, with fewer redundancies than aviation systems. Spaceflight remains inherently more hazardous than air travel, with even the most reliable rockets falling far short of commercial aviation safety standards.

SpaceX appears to have navigated this paradox successfully thus far, maintaining rigorous standards while achieving unprecedented launch cadences. Whether this balance can persist as launch rates continue climbing—and as other providers scale their operations—remains an open question.

Global Implications

The surge in space access carries profound implications beyond commercial telecommunications. Earth observation capabilities are expanding rapidly, with implications for climate monitoring, agriculture, disaster response, and national security. The proliferation of satellite Internet access promises to extend connectivity to underserved regions, though questions of orbital sustainability and space debris management grow more pressing as satellite populations increase.

International collaboration remains robust despite geopolitical tensions. NASA's Commercial Lunar Payload Services program partners with companies globally, Japan's JAXA collaborates on the International Space Station and Artemis lunar program, and the European Space Agency continues multinational cooperation. Australia's emergence as a launch and return hub demonstrates how nations can leverage geographic advantages to participate in the space economy.

China's accelerating space program adds a competitive dimension. The nation's planned megaconstellations will require significant launch infrastructure expansion, potentially challenging U.S.-European dominance in orbital delivery capacity. This competition echoes the Cold War space race, albeit with commercial rather than purely governmental drivers.

The demand curve for space access shows no signs of flattening. Space Force officials stated Cape Canaveral could support up to 156 launches in 2025, with the facility on track to exceed 100 missions. Port Canaveral reported recovering 90 SpaceX boosters and 194 payload fairings during fiscal year 2025 (October 2024-September 2025), highlighting the logistical complexity of high-cadence operations.

How industry and government actors meet this demand—and manage the associated challenges of orbital congestion, debris mitigation, and sustainable space operations—will shape humanity's space-faring future for decades to come. The transformation from space as an exclusive domain of superpowers to a bustling commercial highway accessible to multiple nations represents one of the most significant technological shifts of the early 21st century.

Sidebar: The Twilight of Expendable Rockets

When will throwaway rockets become obsolete? Sooner than most expect.

The space industry stands at an inflection point reminiscent of the aviation industry's transition from wooden biplanes to modern jetliners. Expendable launch vehicles—rockets designed for a single use—have dominated spaceflight since Sputnik. But the economics of reusability are rapidly rendering them obsolete for most missions.

The Tipping Point: 2026-2028

Industry analysts project that expendable rockets will become a niche market within three to five years. SpaceX's Falcon 9 has already demonstrated the viability of reusable first stages, with some boosters flying more than 20 times. When Starship achieves full operational capability—potentially in 2026-2027—it will deliver costs per kilogram to orbit that expendable vehicles simply cannot match.

"The math is brutal for expendables," notes one aerospace economist. A Falcon 9 first stage costs approximately $30 million to manufacture but can fly 15-20 times with refurbishment costs of $1-2 million per flight. An expendable rocket discards that $30 million investment after a single use.

Blue Origin's New Glenn and Rocket Lab's Neutron are both designed for reusability from the start, signaling that even new market entrants recognize the necessity of recovery and reuse. Europe's Ariane 6 and Japan's H3, by contrast, remain fully expendable—a strategic decision that may leave them increasingly uncompetitive in commercial markets.

The Expendable Niche

Three mission categories will likely sustain demand for expendable vehicles:

National Security Missions: Government customers willing to pay premiums for guaranteed performance without the complexities of recovery operations. The United Launch Alliance's Vulcan, while capable of first-stage recovery, will likely fly expendable configurations for certain military payloads requiring maximum performance to high-energy orbits.

Ultra-High-Energy Trajectories: Missions to distant planets or unusual orbits may require expending stages to achieve necessary velocities. Even reusable rocket families like Falcon 9 and New Glenn fly expendable profiles for the most demanding missions.

Small, Specialized Payloads: Niche launch vehicles for specific research missions or rapid-response military applications may remain expendable due to low flight rates that don't justify recovery infrastructure.

Regional Disparities

The transition timeline varies by geography. The United States will likely see expendable rockets relegated to niche status by 2027-2028, with SpaceX's dominance driving the shift. Europe and Japan, lacking operational reusable systems, face difficult choices: invest billions in developing reusability or accept reduced market share in commercial launches while focusing on institutional missions.

China's approach remains unclear. The nation is developing reusable rocket technologies, including the Long March 9 with recoverable boosters, but timelines remain uncertain. Success or failure in Chinese reusability programs could significantly impact the global market.

Australia's emerging launch industry, partnering with international companies, will likely adopt reusable technologies from the start, bypassing the expendable era entirely—much as many developing nations skipped landline telephone infrastructure in favor of mobile networks.

The Cost Revolution

Consider the stark economics: SpaceX charges approximately $67 million for a dedicated Falcon 9 launch with a reused booster. Ariane 6 targets roughly $77-90 million for comparable missions, despite being fully expendable. As SpaceX further reduces costs through Starship, the gap will widen to the point where expendable rockets cannot compete on price for most commercial missions.

By 2028, the launch market will likely divide into two tiers: high-volume, cost-competitive reusable vehicles handling the vast majority of missions, and a small number of expendable vehicles serving niche requirements where recovery isn't feasible or economically justified.

The question isn't whether expendable rockets will become obsolete—it's how quickly, and which companies and nations will successfully navigate the transition. For aerospace engineers who learned that "spaceflight is not routine," the next decade will test whether reusability can maintain reliability while achieving the cost reductions that theory promises. Early evidence suggests it can—and that the age of throwaway rockets is rapidly drawing to a close.

Sources

-

Clark, S. (2025, November 13). With another record broken, the world's busiest spaceport keeps getting busier. Ars Technica. https://arstechnica.com/space/2025/11/with-another-record-broken-the-worlds-busiest-spaceport-keeps-getting-busier/

-

BryceTech. (2025). Global launch activity and payload mass analysis, January 2024–June 2025. [Data compilation cited in Ars Technica reporting]

-

2025 in spaceflight. (2025, November 11). Wikipedia. https://en.wikipedia.org/wiki/2025_in_spaceflight

-

Robinson-Smith, W. (2025, November 10). Florida annual launch record broken with late-night Starlink flight. Spaceflight Now. https://spaceflightnow.com/2025/11/10/live-coverage-spacex-to-launch-29-starlink-satellites-on-falcon-9-rocket-from-cape-canaveral-3/

-

Tribou, R. (2025, November 10). Space Coast launch schedule. Orlando Sentinel. https://www.orlandosentinel.com/2025/11/10/space-coast-launch-schedule/

-

European Space Agency. (2025). Ariane 6 overview. https://www.esa.int/Enabling_Support/Space_Transportation/Launch_vehicles/Ariane_6_overview

-

European Space Agency. (2025, November 4). Ariane launch information. https://www.esa.int/Enabling_Support/Space_Transportation/Ariane

-

Ariane 6. (2025, November). Wikipedia. https://en.wikipedia.org/wiki/Ariane_6

-

Foust, J. (2025, March 6). Arianespace successfully launches Ariane 6's first commercial launch. Spaceflight Now. https://spaceflightnow.com/2025/03/03/live-coverage-arianespace-to-launch-an-ariane-6-rocket-on-its-1st-commercial-mission/

-

Liétar, R. (2025, March 6). Europe's new Ariane 6 rocket successfully puts French spy satellite into orbit. France24. https://www.france24.com/en/live-news/20250306-european-rocket-ariane-6-launches-on-first-commercial-mission

-

Wall, M. (2025, April 29). Vega-C rocket launches European forest-monitoring 'Biomass' satellite to orbit. Space.com. https://www.space.com/space-exploration/launches-spacecraft/vega-c-rocket-launch-esa-biomass-forest-monitoring-satellite

-

European Space Agency. (2025). ESA Council decisions set the stage for more diverse European launch services. https://www.esa.int/Enabling_Support/Space_Transportation/Vega/ESA_Council_decisions_set_the_stage_for_more_diverse_European_launch_services

-

Japan Aerospace Exploration Agency. (2025). H3 Launch Vehicle. https://global.jaxa.jp/projects/rockets/h3/

-

NASASpaceFlight.com. (2025, October 26). JAXA's HTV-X1 launched to ISS aboard H3 Rocket. https://www.nasaspaceflight.com/2025/10/jaxas-htv-x1-launch-h3-rocket/

-

Jiji Press. (2025, October 26). Japan successfully launches H3 rocket with new resupply craft. Nippon.com. https://www.nippon.com/en/news/yjj2025102600156/

-

Associated Press. (2025, October 26). Japan successfully launches new cargo spacecraft to deliver supplies to ISS. ABC News. https://abcnews.go.com/Technology/wireStory/japan-successfully-launches-new-cargo-spacecraft-deliver-supplies-126872531

-

H3 (rocket). (2025, November). Wikipedia. https://en.wikipedia.org/wiki/H3_(rocket)

-

Australian Space Agency. (2025, February 28). World-first historic space return lands in Australia. https://www.space.gov.au/news-and-media/world-first-historic-space-return-lands-in-australia

-

Foust, J. (2025, September 30). Varda Space and Southern Launch agree to more capsule landings in Australia. SpaceNews. https://spacenews.com/varda-space-and-southern-launch-agree-to-more-capsule-landings-in-australia/

-

Premier of South Australia. (2025, March 6). SA's space industry reaches new heights. https://www.premier.sa.gov.au/media-releases/news-items/sas-space-industry-reaches-new-heights

-

Australian Space Agency. (2025). Mobile Launch Rail. https://www.space.gov.au/mobile-launch-rail

-

Southern Launch. (2025). Upcoming Missions. https://www.southernlaunch.space/upcoming-missions

-

Lyall, R. (2025, August 12). First Rocket Launch Highlights Space Momentum in Australia. The Diplomat. https://thediplomat.com/2025/08/first-rocket-launch-highlights-space-momentum-in-australia/

-

Space & Defense. (2024, July 18). Australian Space Agency Flags More US Space Activity. https://spaceanddefense.io/australian-space-agency-flags-more-us-space-activity-in-australia/

-

Blue Origin. (2025, January 16). New Glenn's inaugural mission. https://www.blueorigin.com/news/new-glenn-ng-1-mission

-

NASASpaceFlight.com. (2025, November 12). Following scrub, Blue Origin launch of ESCAPADE on second New Glenn mission now set for Thursday. https://www.nasaspaceflight.com/2025/11/ng-2-escapade-launch/

-

New Glenn. (2025, November). Wikipedia. https://en.wikipedia.org/wiki/New_Glenn

-

Robinson-Smith, W. (2025, January 15). History made: Blue Origin becomes first new space company to reach orbit on its first launch. Spaceflight Now. https://spaceflightnow.com/2025/01/15/live-coverage-blue-origin-to-launch-blue-ring-pathfinder-on-new-glenn-rocket-inaugural-launch-from-cape-canaveral/

-

Goodwin, J. (2025, November 12). NASA scrubs ESCAPADE launch due to 'highly elevated solar activity'. Spaceflight Now. https://spaceflightnow.com/2025/11/11/live-coverage-blue-origin-targets-nov-12-new-glenn-launch-following-weekend-weather-scrub/

-

Tribou, R. (2025, November 9). Weather, cruise ship, pad issues delay Blue Origin's New Glenn launch attempt. Orlando Sentinel. https://www.orlandosentinel.com/2025/11/09/blue-origin-set-for-2nd-new-glenn-launch-today-on-space-coast/

-

Robinson-Smith, W. (2025, February 7). Rocket Lab launches first Electron rocket of 2025 from New Zealand. Spaceflight Now. https://spaceflightnow.com/2025/02/07/rocket-lab-to-launch-first-electron-rocket-of-2025-from-new-zealand/

-

Rocket Lab Corporation. (2025, June 16). Rocket Lab adds two new missions to 2025 Electron launch manifest. Business Wire. https://www.businesswire.com/news/home/20250616667210/en/Rocket-Lab-Adds-Two-New-Missions-to-2025-Electron-Launch-Manifest-Schedules-First-Launch-in-Four-Days-Time

-

Robinson-Smith, W. (2025, November 11). Rocket Lab delays debut of Neutron rocket to 2026. Spaceflight Now. https://spaceflightnow.com/2025/11/11/rocket-lab-delays-debut-of-neutron-rocket-to-2026/

-

Rocket Lab. (2025, October). Wikipedia. https://en.wikipedia.org/wiki/Rocket_Lab

-

Dinner, J. (2025, June 26). Rocket Lab launches "Get the Hawk Outta Here" mission from New Zealand. Space.com. https://www.space.com/space-exploration/launches-spacecraft/rocket-lab-launches-get-the-hawk-outta-here-mission-from-new-zealand-video

-

Wall, M. (2024, November 19). Rocket Lab signs 1st customer for its powerful new Neutron rocket. Space.com. https://www.space.com/space-exploration/launches-spacecraft/rocket-lab-signs-1st-customer-for-its-powerful-new-neutron-rocket

-

Henry, C. (2025). Launch market analysis and capacity constraints. Quilty Space. [Industry analysis cited in Ars Technica reporting]

-

Bednarek, S. (2025, July). Remarks on Falcon launch projections. Industry conference presentation. [Cited in Ars Technica reporting]

-

SpaceX. (2025). Falcon 9 and Starship launch records. [Public launch data and company statements]

-

NASASpaceFlight.com. (2025, November 11). Launch Roundup: New Glenn, Viasat, & Sentinel-6B highlight busy week of launches. https://www.nasaspaceflight.com/2025/11/launch-roundup-111125/

-

Space.com. (2025, November). Space calendar 2025: Rocket launches, skywatching events, missions & more! https://www.space.com/32286-space-calendar.html

-

NASASpaceFlight.com. (2025, September 22). Launch Roundup: Kuiper, Starlink, IMAP headline launch manifest. https://www.nasaspaceflight.com/2025/09/launch-roundup-092225/

No comments:

Post a Comment